America’s Most Splendid Housing Bubbles, April Update: Raging Mania on the Eve of Soaring Mortgage Rates

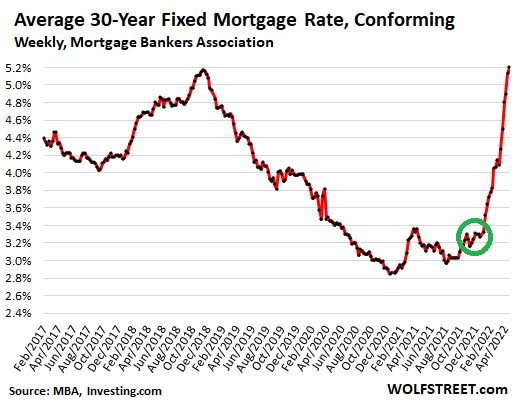

At the time the rate locks were issued for these transactions, mortgage rates were still around 3.2%.

By Wolf Richter for WOLF STREET.

Home prices have soared — including about 30% or more in Phoenix, Tampa and Miami year over year — according to the S&P CoreLogic Case-Shiller Home Price Index today. But this madness took place with the mortgage rates of the end Last yeargiven the long lag of the Case-Shiller index.

The long lag in the Case-Shiller home price index.

The home price data released today was called “February” and represents the three-month average of closed sales that were registered in public registers in December, January, February, mirroring agreements made a few weeks earlier, roughly in November, December and January.

But wait… Many of these homebuyers were pre-approved and had rate locks from weeks and months prior. In November and December of last year, the average 30-year fixed rate hovered around 3.2%, according to data from the Mortgage Bankers Association, which is when homebuyers got rate locks for most of these trades in today’s data (green circle in chart):

The house price data in the charts below does not yet reflect some of the mortgage rate spike that began in January. But it mirrors the mad rush that came before when buyers desperately tried to buy a home with their rate locks still low.

The crazy race at the time.

During the period reflected in today’s Case-Shiller home price data, there has been a mad rush to close deals before mortgage rates rise, and that mad rush is reflected beautifully here with some crazy peaks.

The overall national Case-Shiller home price index for “February” (average of closed deals recorded on public records in December, January and February and closed in the preceding weeks and months) jumped 1.7% compared to the previous month and 19.8% year-on-year.

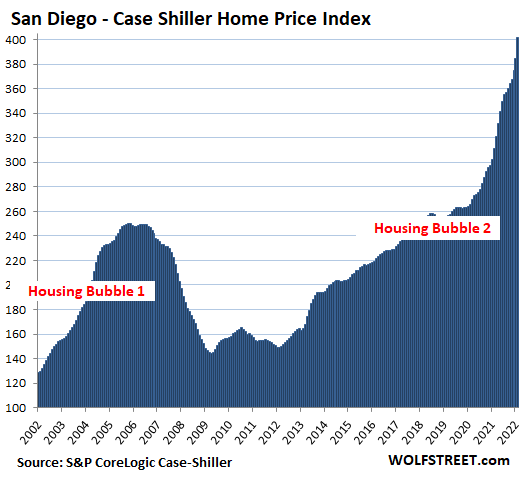

San Diego Metro: Single-family home prices rose 4.5% in “February” from the previous month and 29.1% year-over-year. The index value of 401 means house prices have skyrocketed 301% since January 2000, when the index was pegged at 100.

This price increase amounts to 4.3 times the CPI inflation rate (+70%) over the same period, crowning San Diego the most splendid number 1 housing bubble on this list:

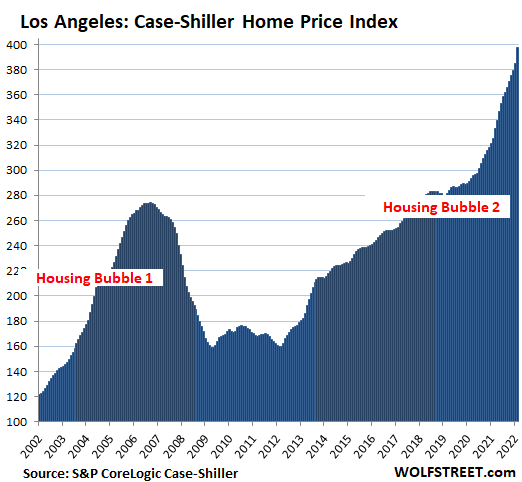

Los Angeles Subway: The Case-Shiller index jumped 3.2% in February from January and 22.1% year-on-year. With an index value of 397, real estate prices have soared 297% since January 2000, crowning Metro Los Angeles as the most splendid number 2 real estate bubble on this list.

It’s just house price inflation: the dollar is losing purchasing power.

The Case-Shiller index’s “sales pairs” method – which compares the price of a home when it sells in the current period to the price when it sold previously – follows the number of dollars it takes to buy the same house over time. The index includes adjustments for home improvements. By tracking the purchasing power of the dollar against the same house, the index is a measure of house price inflation.

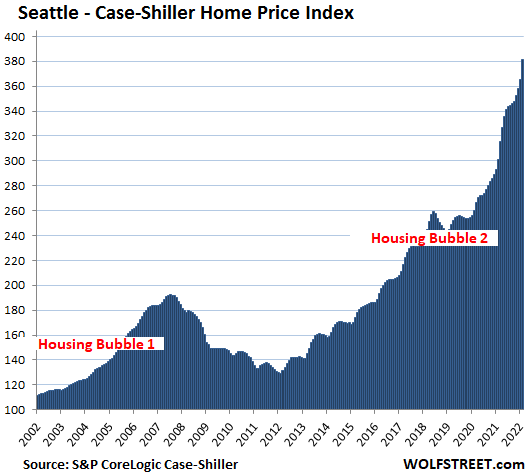

All charts here are on the same index scale, going just above 400.

Seattle Metro: Home prices spiked 4.4% for the month and 26.6% year-over-year. Since January 2000, housing price inflation in metro Seattle has been 281%, four times CPI inflation rate:

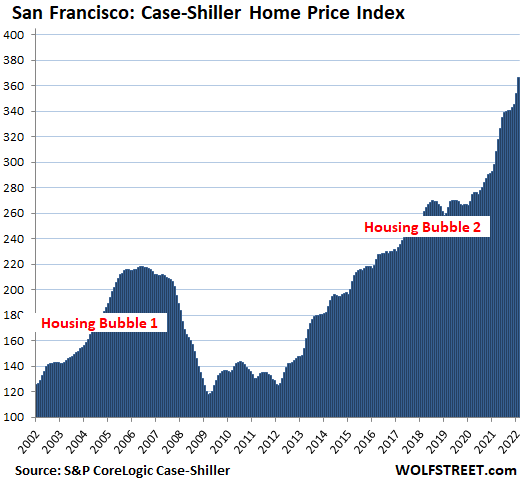

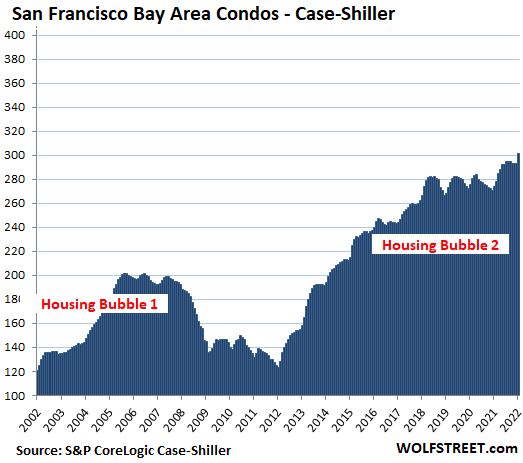

San Francisco Bay Area: Homes and condos separated a few years ago, with condo prices loafing and house prices soaring. The Case-Shiller Index provides separate data for condos and houses for the five counties metro.

Single Family Home Prices in the San Francisco Bay Area increased 3.7% for the month and 22.9% year over year:

San Francisco Bay Area Condo Prices jumped 2.6%, a big outlier, the little thing sticking out on the right, after months of wobble and decline. The index is up 10% year over year. But since June 2018, condo prices have only increased by 6.6%:

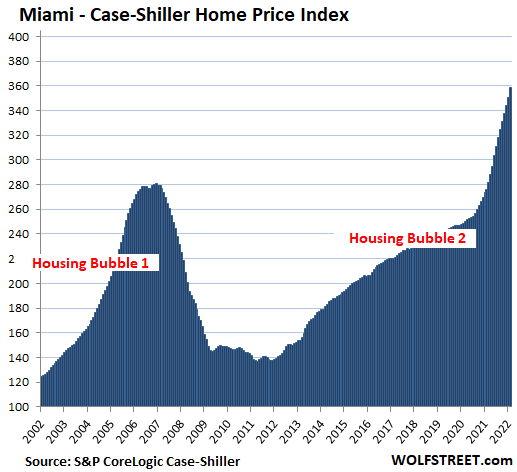

Miami Metro: Home prices climbed 2.3% for the month and 29.7% year-over-year, the fastest since January 2006, on the eve of Miami’s epic Housing Bust:

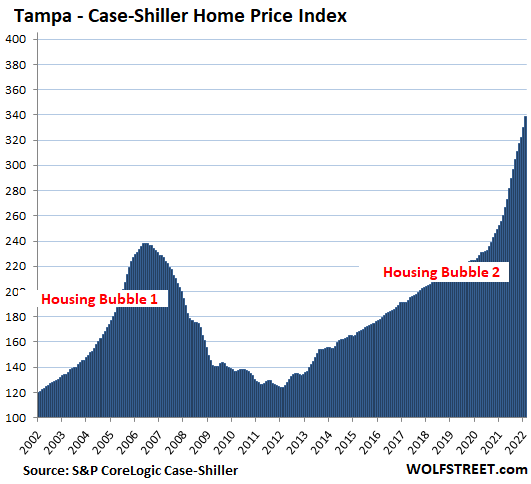

Tampa Metro: Home prices climbed 2.7% for the month and 32.6% year-over-year, another record high for metro Tampa, erasing record highs from previous months and surpassing peaks boobies on the eve of housing bust:

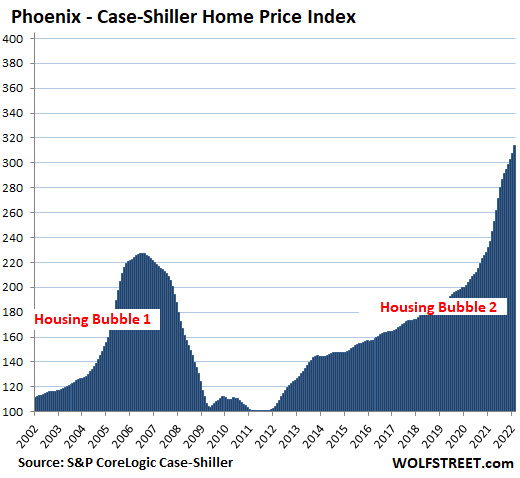

Phoenix Metro: Home prices rose 2.2% for the month and a record 32.9% year-over-year, the eighth consecutive month of year-over-year peaks of more than 30% ‘other :

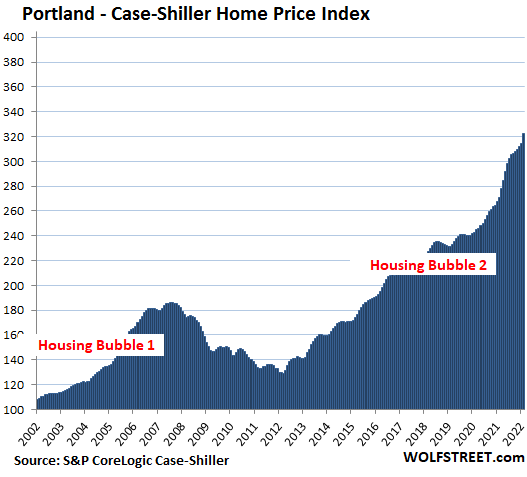

Portland Metro: +2.5% over the month and +19.0% over one year:

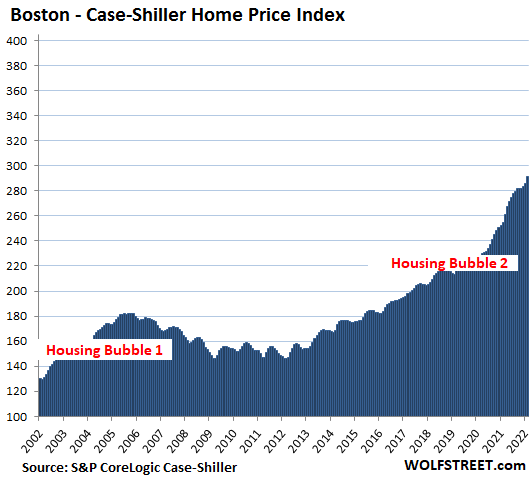

Boston Subway: +2.1% over the month and +14.6% over one year:

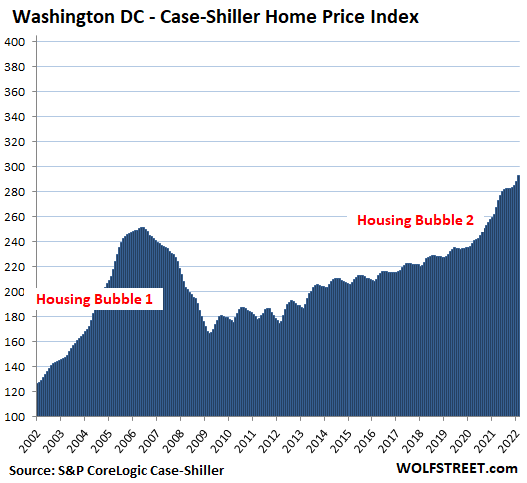

Washington DC Metro: +1.7% over the month and +11.9% over one year:

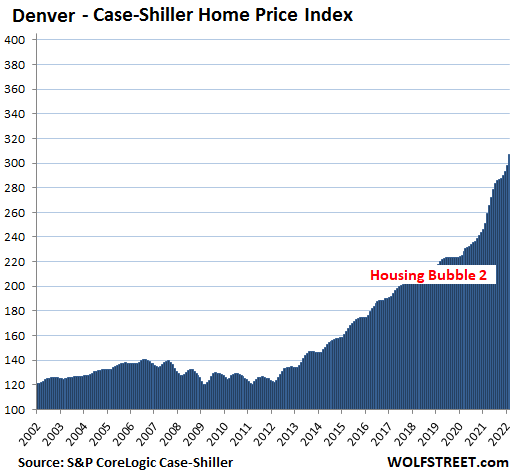

Denver Metro: +3.1% over the month and +22.3% over one year:

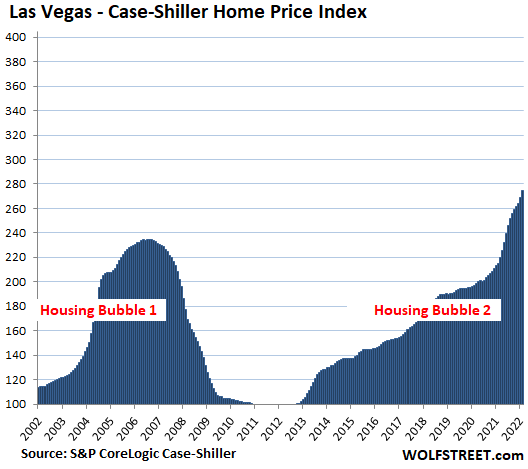

Las Vegas Metro: +2.1% over the month and +27.5% over one year:

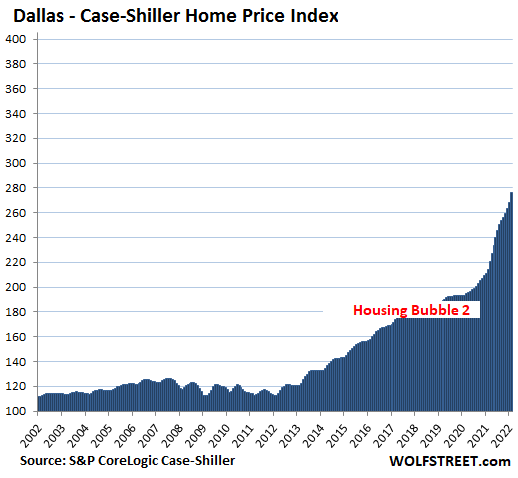

Dallas Metro: +2.9% for the month, and a record +28.8% year over year:

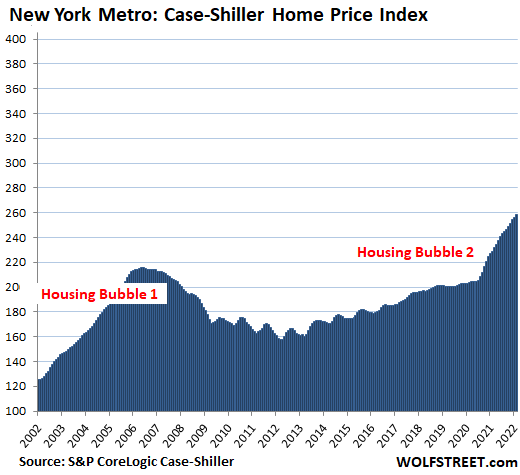

New York subway: +1.1% over the month and +12.9% over one year. At an index value of 259, the Metro has experienced 159% house price inflation since January 2000, compared to 70% CPI inflation.

The other metros in the Case-Shiller index of 20 metros – Atlanta, Charlotte, Chicago, Cleveland, Detroit and Minneapolis – have experienced house price inflation since 2000 that is no match for those splendid bubbles. real estate here, and so they haven’t yet qualified to be included in this illustrious list.

Do you like to read WOLF STREET and want to support it? You use ad blockers – I completely understand why – but you want to support the site? You can donate. I greatly appreciate it. Click on the mug of beer and iced tea to find out how:

Would you like to be notified by e-mail when WOLF STREET publishes a new article? Register here.

![]()

#Americas #Splendid #Housing #Bubbles #April #Update #Raging #Mania #Eve #Soaring #Mortgage #Rates