Archegos Founder Bill Hwang Arrested for Fraud in US

Bill Hwang, founder of collapsed family office Archegos Capital Management, has been arrested by US authorities and charged with racketeering, fraud and market manipulation.

The indictment released on Wednesday accuses Hwang, 58, and former chief financial officer Patrick Halligan, 45, of using archegos as an “instrument of market manipulation and fraud” with “considerable consequences for other participants in the U.S. stock markets”.

The case, brought by federal prosecutors in Manhattan, marks the first criminal charges against Hwang, one of the so-called Tiger Cub veterans of Julian Robertson’s Tiger Management fund, whose little-known investment vehicle has rocked some of Wall Street’s biggest financial institutions when it imploded. one year ago

“The scale of the exchanges was staggering,” said Damian Williams, U.S. Attorney for the Southern District of New York.

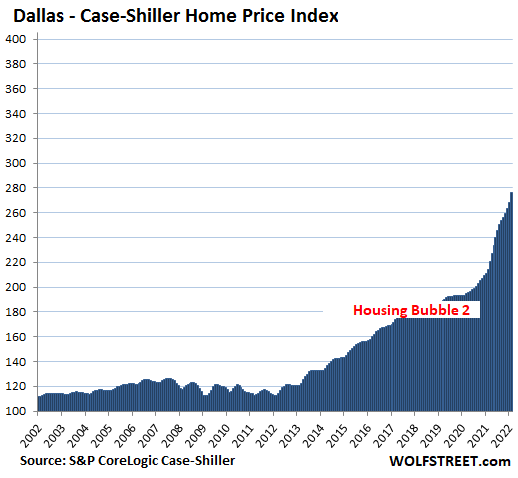

While Archegos was a relatively obscure family office, it managed to attract many big lenders. Archegos’ capital grew from $1.5 billion in March 2020 to $35 billion a year later, with the group’s positions reaching up to $160 billion.

Archegos’ collapse caused billions of dollars in losses for investment banks including Credit Suisse, UBS, Nomura and Morgan Stanley after it defaulted on margin calls, with more than $100 billion wiped out of valuations of nearly a dozen companies while Archegos’ positions were unwound.

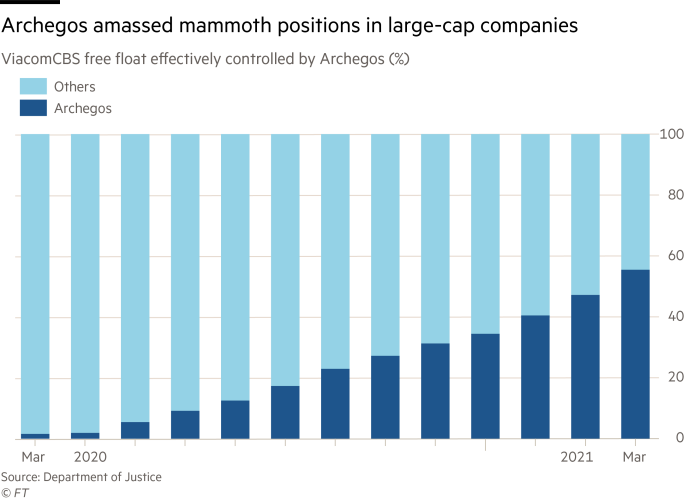

The group used money borrowed from banks such as Morgan Stanley and Credit Suisse to amass multi-billion dollar positions in US-listed companies such as ViacomCBS – now known as Paramount – and the online retailers Shopify and Farfetch. By using derivatives, where the bank it was dealing with bought or sold shares on behalf of Archegos, the company left no visible footprint of its activity to the investing public.

“This program had historic significance,” Williams said. “The lies have fed the [stock price] inflation and inflation fueled more lies. It was spinning and spinning. But last year, the music stopped, the bubble burst, prices plummeted, and in the process, billions of dollars almost evaporated overnight.

Hwang and Halligan pleaded not guilty at an arraignment hearing in Manhattan federal court.

Dressed neatly in a green polo neck sweater, Hwang agreed to sign a $100 million bond, which will be secured by $5 million in cash and an interest in two properties, including his house.

The former hedge fund manager agreed to travel restrictions limiting his travels to New Jersey, Connecticut and parts of New York. He said he had lost his passport and promised not to apply for a new one, a government lawyer told the court.

A lawyer for Hwang said Wednesday that the investor was “completely innocent of any wrongdoing” and that the allegations were “exaggerated.”

“We are extremely disappointed that the US Attorney’s office has seen fit to prosecute a case that has absolutely no factual or legal basis; A lawsuit of this type, for open-market transactions, is unprecedented and threatens all investors,” said Lawrence Lustberg, Hwang’s attorney.

A lawyer for Halligan said he was innocent and “will be cleared”.

Scott Becker, who was director of risk management at Archegos, and William Tomita, the family office’s chief trader, were also charged for their role in the alleged plot. They have pleaded guilty and are cooperating with the US government, according to the Justice Department.

The Securities and Exchange Commission filed a parallel civil action against Archegos and Hwang on Wednesday morning. He said that as of March 2021, Archegos’ derivative and equity positions in ViacomCBS accounted for more than half of the company’s freely tradable stock.

The SEC said that in June 2020, when asked by a colleague whether the relative resilience of ViacomCBS stocks “was ‘a sign of strength'” on a day when the broader stock market fell, Hwang texted : “No. It’s a sign that I’m buying. He added the emoji for tears of joy or laughter, the SEC noted.

The Commodity Futures Trading Commission has also filed civil fraud charges against Archegos and Halligan.

Prosecutors allege that Hwang and Halligan operated two interrelated criminal schemes. They accused Archegos of disguising its trading and positions so that its counterparties and other market traders would believe that “the prices of these stocks were the product of the natural forces of supply and demand when in truth they were the artificial product of Hwang’s manipulative trade”. “.

The indictment also alleges that the defendants misrepresented the group’s investment plans and holdings as Archegos tapped into billions of dollars in credit from major Wall Street lenders to back its deals.

While these banks knew Archegos was betting on a relatively small number of deals, prosecutors said, they were misinformed of the scale of those deals and had been assured by the family office that Archegos could exit its deals in just of them.

But that was not the case. Last year, the group’s position in ViacomCBS exceeded $20 billion and its deals in the media company accounted for more than 10% of the stock’s daily business. Prosecutors noted that it would have taken more than three months for Archegos to sell ViacomCBS stock without significantly changing the price.

According to prosecutors, Hwang also sometimes coordinated transactions with an unnamed former colleague who runs a hedge fund. When Archegos sought in 2021 to increase its position in GSX Tecedu, it reached limits with one of its main brokers refusing to buy a larger stake in the US-listed Chinese education company. . This limit limited its ability to enter into new swap contracts on GSX with one of its clients.

Hwang knew that the former colleague, described as a “close friend”, held a similar position at GSX Techedu at the same bank, according to the indictment. Prosecutors allege he “tricked” this individual into moving his position to another bank, giving Archegos the opportunity to increase his position in GSX.

The fall of Archegos has prompted new rules from SEC regulators, which are pushing to revamp disclosures for big investors.

Additional reporting by Mark Vandevelde in New York

#Archegos #Founder #Bill #Hwang #Arrested #Fraud