Why did Wall Street loan billions to alleged fraudster Bill Hwang?

Bill Hwang secured billions of dollars in funding from major Wall Street banks with lies ranging from assurances he could quickly exit positions to claims he held large, easily tradeable stocks like Apple and Google , according to US authorities.

The banks apparently took Hwang’s words at face value when they entered into leveraged derivatives transactions with Hwang’s family office, Archegos Capital Management. Those deals allowed him to hide the size of his huge positions in half a dozen U.S. stocks from the wider market and the banks themselves before the program collapsed in March 2021.

After Hwang’s arrest on Wednesday for federal racketeering, fraud and market manipulation, Wall Street has faced fresh questions about how sophisticated trading desks and compliance departments fell for his alleged misrepresentations — and have lost over $10 billion in the process.

“The systems used to track risk were not up to date, in terms of technology,” said Darrell Duffie, professor of finance at Stanford. “There have been glaring lapses in common sense about how much risk of loss a client is too great, and an apparent reluctance by some officials to confront Archegos with difficult questions.”

Archegos’ alleged deceptions were detailed in an indictment filed by the US Department of Justice and in complaints issued by the Securities and Exchange Commission and the Commodity Futures Trading Commission.

“These deceptions prompted Archegos’ counterparties to continue trading with it and extend leverage beyond what the counterparties’ risk tolerance would have otherwise allowed them to have known the truth,” said the SEC in its complaint.

Hwang pleaded not guilty to an arraignment in Manhattan federal court, while his attorney said the indictment “has absolutely no factual or legal basis.”

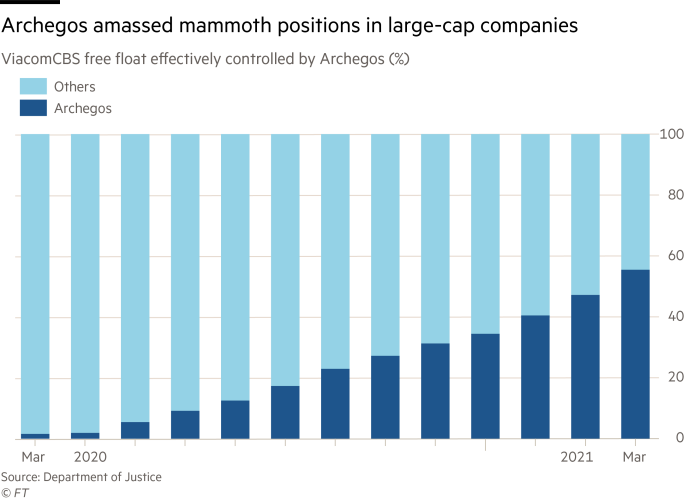

Archegos kept a low profile in part by using derivatives that shielded it from public scrutiny. While the investment group typically first bought the shares of a company it wanted to own, it changed course once its ownership approached 5% of the company – a threshold that would trigger regulatory disclosures in the USA.

Instead, he would increase his positions through instruments called total return swaps. This meant that Archegos could make or lose money depending on whether a stock went up or down, but the bank it made the deal with was the actual buyer of the stock.

Hwang’s derivatives trading has allowed him to swell his assets from $1.6 billion to more than $36 billion in just 12 months. At one point, Archegos owned or had derivative exposure to more than 50% of the outstanding shares of media company ViacomCBS, now known as Paramount Global.

While trying to persuade UBS to raise its trading limit, Hwang’s team told the Swiss bank that Archegos could unwind its entire portfolio in about a month without serious market disruption, the DoJ alleged. in his indictment. In reality, according to the DoJ, Archegos would have needed about well over 100 days for this.

Archegos also informed UBS that it held large positions in liquid stocks like Amazon, Google and Apple along with other banks. But in reality, his bets were similar across all other banks on less liquid stocks like ViacomCBS and online retailer Shopify, as well as U.S.-listed Chinese companies like tech firm Baidu.

UBS, which lost $861 million due to the Archegos debacle, ended up increasing Archegos’ trading limits by about $2 billion “based in part on these misrepresentations,” it said. the DoJ.

UBS declined to comment on whether or not it should have done more due diligence before extending Archegos’ credit limit.

The DoJ alleged that Archegos “made similar misleading, false and misleading statements regarding the size of Archegos’ largest positions on other occasions and at additional counterparties”, to bankers at Goldman Sachs, MUFG, Credit Switzerland, Nomura, Deutsche Bank and Macquarie.

The banks were victims of Archegos’ false declarations and also “a victim of wanting to continue to have him as a client [and] money at stake,” said Robert Webb, professor of finance at the University of Virginia.

In another case of alleged deception, the DoJ alleges that Archegos provided Goldman with “fictitious” or “decoy” names when discussing its investment interests to give the impression that its portfolio was broader than he was not. He ended up using Goldman to trade shares similar to those he had with other banks.

The DoJ alleged that Archegos also misled Morgan Stanley, using false claims when it rejected a request to replace some of its stakes in Chinese education technology company Gaotu Tecedu with larger shares. liquids like Apple and Amazon.

Deutsche said in a statement that it was “significantly de-risking our exposure to Archegos without incurring losses.” Goldman Sachs, Morgan Stanley, MUFG, Credit Suisse, Nomura and Macquarie declined to comment.

Wall Street’s risk management teams focused on the size of Archegos’ positions as well as the amount of each stock traded each day. The larger the trading volume, the more acceptable it was for a bank to lend against a particular stock.

The reason: In the event of default, if a bank were to claim the stock as collateral and sell it in the open market, the relatively illiquid positions would be difficult to sell without driving the stock price down significantly, resulting in losses. potential for the broker.

However, a 2021 report by law firm Paul Weiss on Credit Suisse’s $5.4 billion Archegos losses said its Wall Street counterparties knew Archegos had tended to make concentrated bets. This was also the case with Tiger Asia, the hedge fund Hwang ran before settling insider trading charges with the SEC in 2012.

#Wall #Street #loan #billions #alleged #fraudster #Bill #Hwang